Zoopla House Price Index: January 2024

29th January 2024

29th January 2024

Zoopla's first Hous Price Index of the year has been published today giving the data as at the end of December 2023.

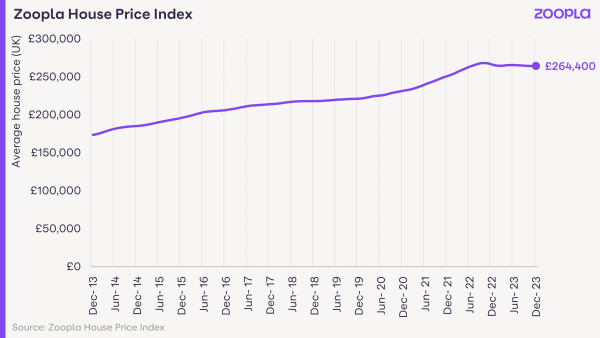

The average house price in the UK is £264,400 as of December 2023 (published in January 2024).

Property prices have not changed compared to the previous month and they have fallen -0.8% compared to the previous year.

| Type of property | December 2023 | November 2023 | October 2023 | Year-on-year change to December 2023 (£) | Year-on-year change to December 2023 (%) |

|---|---|---|---|---|---|

| All property | £264,400 | £264,400 | £264,600 | -£2,100 | -0.8% |

| Detached houses | £447,500 | £448,400 | £448,600 | -£5,800 | -1.3% |

| Flats | £190,200 | £190,500 | £190,300 | -£2,200 | -1.1% |

| Semi-detached houses | £268,700 | £268,900 | £268,400 | -£2,000 | -0.7% |

| Terraced houses | £232,500 | £232,400 | £232,500 | -£1,700 | -0.7% |

The graph shows how the average UK house price has changed since 2013, now sitting at £264,400.

House prices continue to adjust to higher mortgage rates through modest price falls. However, price falls are slowing as more sales are agreed at the start of 2024.

House prices have fallen -0.8% in the year to December 2023, compared to a -1.4% fall in the year to October 2023.

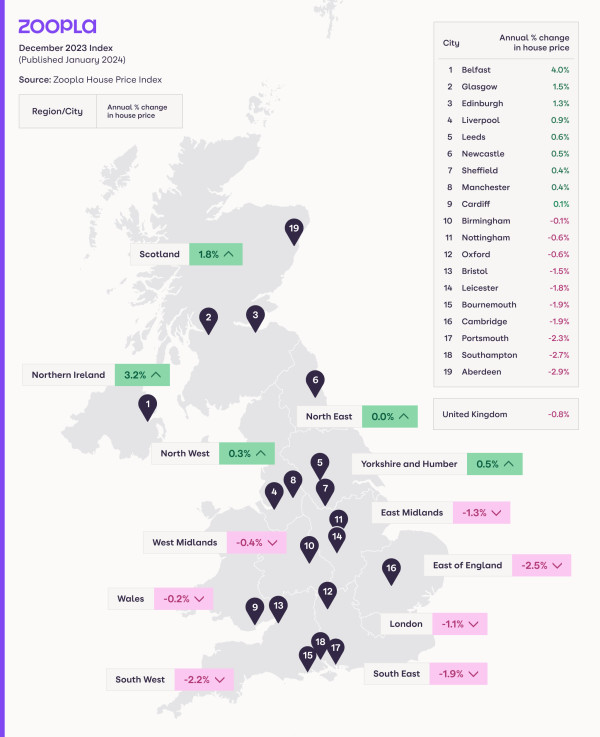

The largest price falls are in the East of England (-2.5%) and the South West (-2.2%). Northern Ireland is an outlier with house prices up 3.2% over 2023.

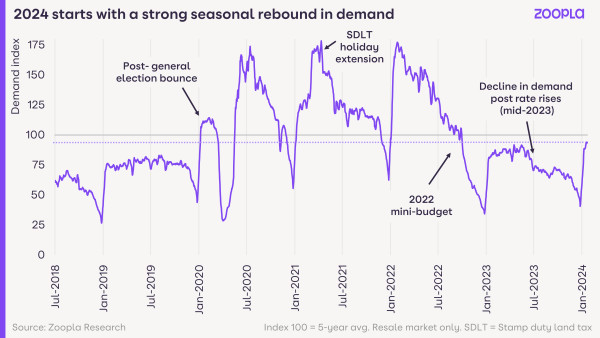

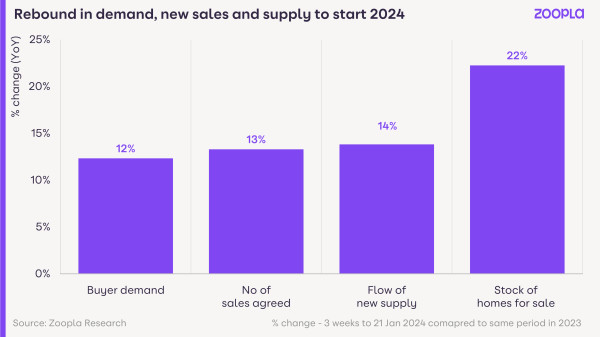

There has been a strong seasonal uplift in buyer demand in the first 3 weeks of 2024.

Sub-5% mortgage rates mean buyer demand is sitting 12% higher than a year ago, although still 13% below the 5-year average.

This reflects a return of pent-up buyer demand following a weak second half of 2023. Many buyers delayed moving in the face of rising mortgage rates.

The uplift in agreed sales in the final weeks of 2023 has continued into 2024. This suggests buyers and sellers are becoming more aligned on pricing after over a year of tussling.

New sales are 13% higher than a year ago and up across all countries and regions, most markedly in Yorkshire and the Humber (+19%) and the West Midlands (+17%).

There’s also been a 22% uplift in the flow of homes listed for sale. This indicates that people are feeling more confident in listing their home for sale again, boosting choice for buyers and keeping prices in check.

London and the East of England have seen the biggest rebound in buyer demand at the start of 2024.

Most other areas recorded increases in buyer demand, but below average levels - typically in line with last year or higher by single digits.

All markets in London have seen a similar uplift in demand, including inner, suburban outer and core commuter areas around the city.

This could reflect a turn of fortunes for the London housing market.

Over the last 7 years, the capital has lagged behind the rest of the UK in house price growth and sales numbers. House prices have risen 13% in London since 2016 compared to 34% in the UK and 50% in Wales. Flat prices in London rose just 2% in this time.

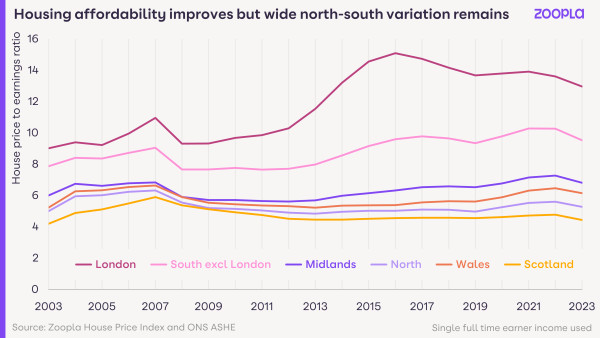

London reached its lowest affordability in 2016 with the house price to earnings ratio at more than 15:1. A number of factors subsequently hit demand and pricing, including:

Tax changes aimed at investors and overseas buyers

The Brexit vote hitting jobs growth

The global pandemic closing down travel and changing working patterns

Higher mortgage rates which stunt the most expensive housing markets the most

London is now the most affordable it’s been since 2014 thanks to low price inflation and rising earnings. However, it’s still expensive by UK standards with a house price to earnings ratio of 13:1. The chart below shows how this compares to other UK regions.

Improving affordability in London is positive news but home buyers still face a huge challenge with mortgage rates twice as high as in 2021.

We expect London’s market conditions to keep improving in 2024 with earnings rising faster than house prices, which will support sales numbers.

Search property for sale in London

It’s good to see renewed activity in the market but it’s important not to over-interpret what this might mean for 2024.

Last year, mortgage rates fell to 4.2% in the first 3 months of the year, which supported sales volumes and led to only modest price falls.

We expect current mortgage rates to have the same effect this year, supporting sales volumes rather than hugely impacting house prices.

House prices will be kept in check by several factors:

A greater supply of homes for sale giving buyers more choice, especially for larger family homes.

Half of those with a mortgage are yet to refinance onto a higher mortgage rate, keeping people price-sensitive and focused on value when they move house.

A small but not insignificant number of sellers cutting their asking prices to attract interest, continuing this 2023 trend.

1 in 5 sellers accepting more than 10% off the asking price, and close to 1 in 4 across London and the South East.

If you’re selling your home, price realistically if you’re serious about moving. Improved market conditions will help you get a sale - but don’t take that to mean you’ll get a result at a higher price.

Get a free valuation from local agents

The adjustment to higher mortgage rates was always going to take longer than a year, especially given the only modest fall in house prices in 2023.

It seems unlikely that mortgage rates will fall much further in the near term, remaining in the 4% to 5% range and the best deals for big deposits.

Lower mortgage rates are welcome news but will support sales rather than price rises in 2024.